On-chain analysis examines the blockchain’s public data. It’s a new sector that’s exclusive to the cryptocurrency industry, with traders utilizing it to better forecast market swings and evaluate market mood. Finally, traders employ on-chain research to determine why various market players purchase and sell, such as miners selling to pay their bills or hedge funds profiting.

On-chain research looks at how various market players, including as institutional investors, exchanges, miners, and retail dealers, are acting. They use a variety of indications, such as wallet balances, coin dormancy, and transaction volume.

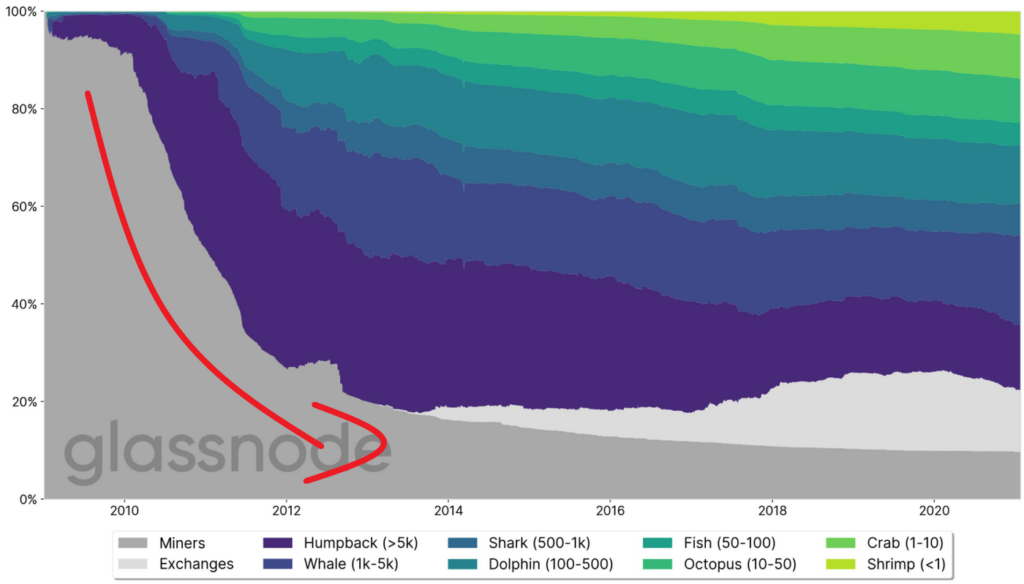

As seen in the Glassnode figure above, the proportion of bitcoins owned by miners and big holders has declined drastically, while the number of coins held by ordinary investors has climbed greatly. This is an essential measure since it reveals that the network is becoming more decentralized over time.

Also, traders can use the above information to figure out how much different market players affect the price. “We have noticed a big growth in bitcoin whales (and their supply) since 2020,” said Rafael Schultzre-Kraft, co-founder and CTO of GlassNode. This indicates that institutional investors, funds, family offices, and other [high net worth individuals] HNWIs have entered the area.”

On-chain indications that are useful include:

The total number of active addresses

The total number of transactions

Volume on the chain

The hash rate

Revenue from miners

Total value secured (TVL)

converting market value to realized value (MVRV)

Transaction value to network (NVT)

Capacity attained