To invest in cryptocurrencies, you need to do a lot of research and look at all the available metrics. Most projects will give you a lot of information about what the coin is for, how it works, who made it, and how far it has come so far. Using fundamental analysis, you can get an idea about crypto by using a mix of quantitative and qualitative factors.

A common belief among newcomers is that cryptocurrencies can’t be valued using fundamental analysis because of how volatile the market is. Even though the value of the asset may depend on the whims of traders around the world, it is still possible to make an informed guess about it.

Understanding fundamental analysis can help you decide whether to buy or sell a cryptocurrency. We’ll show you how to use fundamental analysis to figure out what to think about when analyzing cryptocurrency. We’ll also look at how cryptocurrency analysis is different from traditional asset analysis.

What is a fundamental analysis?

Fundamental analysis finds an asset’s “intrinsic value,” which is a measure of its worth that is supposed to be based on facts. By looking at the data behind crypto projects, you can tell if the coin is undervalued or overvalued as an asset.

The markets for cryptocurrencies are known to be very unstable. Even well-known currencies like Bitcoin and Ethereum can change in a hurry. Investing in newer coins and tokens is a risky business if you don’t know what you’re getting into.

Fundamental analysis lets both investors who don’t know much about technology and traders with a lot of experience trade with confidence. With the help of fundamental analysis, traders can come up with strategies that are more likely to make money.

Technical analysis, on the other hand, is useful for traders and investors who want to predict the direction of the financial market using technical indicators like RSI, MACD, and Bollinger Bands.

What is different about crypto fundamental analysis?

Benjamin Graham and David Dodd wrote Security Analysis in 1934. This book is often called the bible of how to value securities. Even now, investors use the metrics from their classic book to test the value of financial assets. For example, when using numbers to evaluate stocks, you can use earnings per share (EPS) or the price-to-earnings ratio (PE ratio) to figure out how much a share is really worth.

When it comes to reporting requirements, cryptocurrency isn’t always subject to international rules, unlike publicly traded companies, which often have to make quarterly reports using recognized accounting standards. Traditional business metrics like liquidity ratios, which look at how financially stable a business is, are no longer useful. The whole idea behind the project is that no one company or group should own or be in charge of it, and the way information flows will be different.

All transactions in crypto markets can be “audited” by the public on the blockchain, and the founding team must keep the community up to date on their plans.

Conceptually, investors still need to learn about the project they are investing in, but the metrics they use are very different from those used to analyze traditional markets.

Considerations for a fundamental analysis of crypto:

The main goal of fundamental analysis of crypto is to reduce investor risk and figure out how much money the asset could make.

There are three main ways to use fundamental analysis:

Metrics for Blockchain (On-chain Metrics)

The blockchain is a useful tool, but pulling information out of the raw data by hand can take a lot of time and money. APIs, or application programming interfaces, give people the tools they need to make better investment decisions. Leading cryptocurrency exchanges have made reporting tools that give a lot of useful data, such as the number of active users, the total number of transactions, and the value of each transaction.

The hash rate, the status, and the number of active addresses, as well as the transaction values and fees, are the three most important metrics for a fundamental analysis of a cryptocurrency. Let’s look more closely at how this data can help traders.

Hash Rate: Blockchain is a big part of keeping the network safe, and looking at the data can help with crypto fundamental analysis.

Proof-of-Work (PoW) is a type of blockchain that is used by cryptocurrencies like Bitcoin and Ethereum. PoW requires crypto miners to figure out how to solve a computer puzzle that verifies each transaction and stops bad people from taking control of 51% of the blockchain. If they did, they could change or stop other transactions that didn’t belong to them, or they could spend their own money twice.

Hashrate Glassnode Image CC: Hashrate

The hash rate is the total amount of computing power that is used to do calculations on a Proof-of-Work (PoW) blockchain. Hash rates are estimated based on information that is available to the public, but the real hash rate will never be known.

Many crypto investors look at hash rates as a sign of how healthy a cryptocurrency is. The network is safer and more secure if there are more miners who want to mine in order to make money. Miners can also figure out how profitable they are by calculating their own hash rate.

But when the hash rate starts to go down, miners may decide that the cryptocurrency is no longer worth their time, which is called “miner capitulation.” Capitulation usually happens when the market goes down and miners feel pressured to sell their hardware. Less interest from investors is shown by a drop in the hash rate.

Status and Addresses in Use

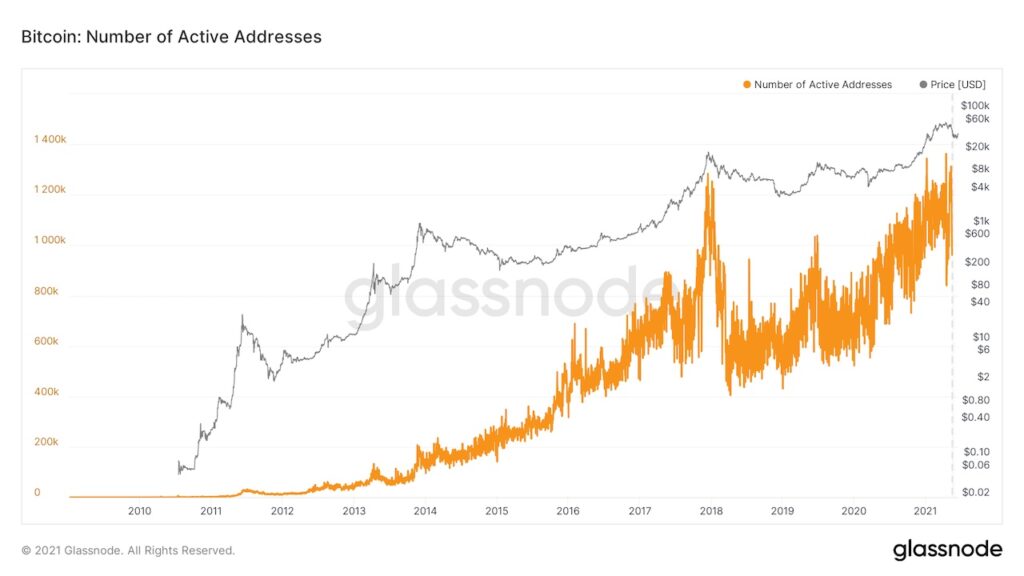

Picture of Bitcoin Active Addresses CC: Glassnode has a list of Bitcoin active addresses

Active addresses count the number of addresses on the blockchain that are still in use after a certain amount of time. One of the easiest ways to do this is to add up the number of senders and receivers over different time periods. Count the active addresses over a period of days, weeks, or months and compare the increase or decrease to figure out how popular the coin or token is and how active it is.

Another way is to add up the number of unique addresses in certain time periods and then compare the results.

Value of the Transaction and Fees

Unlike the technical analysis, the fundamental analysis also puts the value of transactions at the top of its list of priorities. If five Bitcoin transactions of $250 each happened on the same day, the total value of all of those transactions would be $1,250.

A currency is in steady use when its transaction value stays high, and comparisons give information about how the market might move in the future.

Fees show how busy the blockchain is, or how many transactions are paying to be added as soon as possible. Ethereum’s gas is an example of a transaction fee, but each cryptocurrency can have its own.

When you look at the fees paid over different time periods, you can figure out how safe the coin or token is. Over time, transaction fees can naturally go up, while the block subsidy or block reward goes down as mining gets harder. If the reward wasn’t changed, crypto miners would start losing money and drop off the blockchain.

Financial Metrics

The goal of fundamental analysis is to come up with a number that an investor can use to figure out how an asset will do in the future. To evaluate crypto from a financial point of view, you need to know how assets trade, including their liquidity, the factors around them, and how the market reacts.

All of these are useful for crypto fundamental analysis, especially when figuring out if an investment is a good idea before making a plan.

The size of the market (Market Cap)

The value of a network is shown by its market capitalization value. You can figure it out by multiplying the price right now by the number of coins in circulation. If you don’t take into account other metrics, such as liquidity, market capitalization can give you wrong valuations. After all, just because an altcoin isn’t used much but has a total supply of 50 million and has been traded for $1 a few times doesn’t mean that each coin is worth $1.

In general, investors may think that coins with a low market cap have more room to grow, but a high market cap can also mean that the coin has a stronger infrastructure and will last longer. Even though lost money, lost wallets, and keys that can’t be found again mean that we’ll never know for sure how many coins are in circulation, market capitalization gives us a good idea of a coin’s value on the network.

Liquidity and the Number of Trades

How easy it is to buy and sell an asset is a measure of its liquidity. The liquidity of a cryptocurrency asset is strong if it can be bought or sold quickly without changing the market value by a lot. There will be a lot of buyers and sellers in an order book for a cryptocurrency coin or token that is easy to trade. This makes the bid-ask spread, which is a good way to measure how liquid a market is, get smaller.

Trading volume is a good way to figure out if a coin or token can keep going. The measure shows how many units of an asset have changed hands over a certain time period. If the price is going up and there are a lot of trades, the gains may be more likely to stay. On the other hand, price changes without a lot of trading activity may just be blips on the radar.

Supplying the Market

The total number of coins that are in use and available to the public is called the “circulating supply” of a cryptocurrency. The circulating supply is not the same as the total supply or the maximum possible supply. This is because coins can be burned, so the circulating supply can change over time.

Developers can make a centralized supply of coins or tokens have more of them. With a cryptocurrency that can be mined, mining can increase the number of coins in circulation.

Measuring a project

Project metrics use a qualitative method to judge how well a cryptocurrency is doing. They pay attention to both internal and external things, like what the cryptocurrency is for and how the cryptocurrency project works.

A look at the past

On the websites for crypto projects, there will be a list of the people who work on them. Getting to know the team members and their past work can help you figure out how likely it is that the current project will be a success. The team you’re counting on to follow the road map should have a good record of their past experience and successes. You could also look at the project’s early backers or advisors in order to figure out how credible it is.

White Paper on Crypto

The white paper for crypto is a technical document that explains what the project is for and how it works. It is the most important document for the project and should at least include the following:

Solutions for blockchain technology

Different ways to use the currency

Features and upgrades that are planned

Information about the price and sale of tokens

Info about the team

Look at the white paper with a healthy dose of skepticism and keep an eye out for reviews of the project from other people.

Competitor Comparison

Competition in the market sorts out the winners from the losers. By doing a thorough search for market competitors, you can figure out how each project will compete in the market. To figure out how good a project could be, you need to know about the whole ecosystem.

Plan for a product

Most crypto products have a plan for the future that shows when test nets, releases, and new features are going to happen. The road map should give a clear picture of what will happen next. Use the road map to see if you’ve reached important goals.

Token Economics and Use

Tokenomics is the study of how people buy and sell tokens. Cryptocurrencies are worth and cost what people are willing to pay for them. The price goes up when there is more demand than supply. The structure of incentives used to get people to act in a certain way on a network is also part of the theory of tokenomics.

The role a token can play is shown by how useful it is. If a token has more real-world uses, it might get more people to use it and pay attention to it.

What Else About the Analysis of Cryptocurrency?

Quantitative analysis is a great way to give investors a broad view of the financial metrics that can be measured by numbers. But it doesn’t include things about the company or risks that can’t be measured by a number. That’s especially true when crypto is the target market and there are so many other things to think about. Still, social politics and how users act can have a big effect on the business fundamentals of an asset.

Sociopolitical Environment

The Covid-19 pandemic showed investors what a real global crisis would be like and how it would affect the financial markets. As the pandemic got worse, all assets, including cryptocurrencies, sold off. Between March 7 and March 13, 2020, Bitcoin fell by 58%. Investors left speculative assets because they didn’t want to take any risks.

As a result of the crisis, governments all over the world passed stimulus packages worth trillions of dollars, and crypto became popular again. Since central banks are printing a lot of fiat currencies, investors may look to cryptocurrency as a way to store value and protect themselves from inflation.

Uncertain regulatory frameworks can also hurt cryptocurrency markets. For example, sudden bans from Turkey and China show that governments still have a say.

User Behavior

The goal of fundamental analysis is to give investors a complete picture. And user behavior is one of the hardest things to figure out. Social media, the crypto community, and marketing in general can all have big effects on how people use the internet and how they act in the market, but it can be hard to predict what those effects will be.

After all, a few tweets from Elon Musk could lead to a field of dog coins and memes coins. In general, taking into account how many people follow a network and how much they interact with it shows how committed users are to the project.

Tools for analyzing

As the trading of cryptocurrencies has grown, so has the use of analytics like network statistics and technical market analysis. The biggest challenge in education is turning all the publicly available information into a format that can be used.

Charting tools like TradingView, news aggregators, rebalancing portfolios, and block explorers all help a crypto environment with a lot of data.

Each and Every Drop

As institutional demand for crypto grows, traditional ways of valuing crypto help to explain why their trading prices are what they are. Fundamental analysis in crypto is a little different from traditional markets, but there are more and more resources to help you learn. A thriving ecosystem is made up of exchange platforms with a lot of users, crypto trading bots, and active communities.

As with any investment, you should do your research. In the cryptocurrency markets, investors who do careful research and fundamental analysis can make a lot of money. Information and research reduce the risk of an investment. So do your research and spread out your investments.