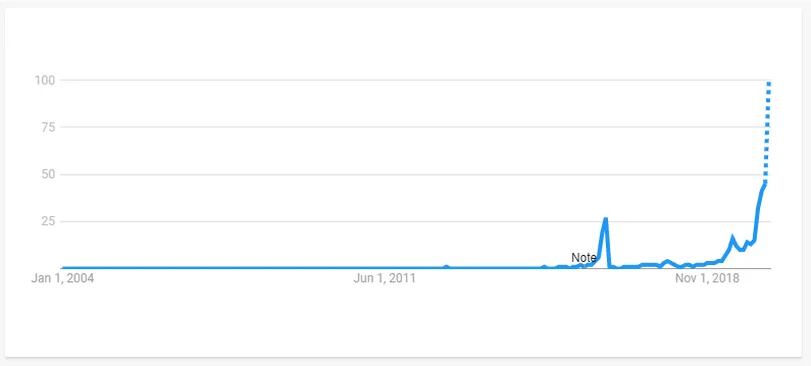

With Bitcoin’s third halving just around the corner, a surge in interest is evident, marked by all-time high Google searches. However, some traders express skepticism about the traditional bullish narrative associated with halving events. Instead, they shift their focus to other macroeconomic factors, such as unprecedented central bank policies, as potential drivers for Bitcoin’s price in the coming months and years.

Matthew Kaye, Managing Partner at Blockhead Capital, dismisses the bullish halving thesis, suggesting that much of the debate around it is merely “spinning wheels.” While acknowledging the potential for increased demand and a reduction in new supply post-halving, he deems the supply shock negligible compared to regular trading volumes.

Francis Pouliot, CEO of Bull Bitcoin, emphasizes the long-term impact of a “loss of confidence in other assets,” making him “insanely bullish” on Bitcoin. He contrasts the “marketing impact” of the Federal Reserve’s quantitative easing efforts, which he finds incomparably higher than the predictable nature of the halving.

Bitcoin options markets reflect a hesitancy to view the halving as an unequivocal bullish event. The put-call open interest ratio has steadily climbed in April, indicating a market more focused on hedging against potential downside risks associated with the approaching halving.

Zoran Scekic, Managing Partner at Zorax Capital, anticipates an unexpected pullback after the halving, a sentiment echoed by Ryan Watkins, Bitcoin Analyst at Messari. Watkins expresses skepticism about Bitcoin’s ability to decouple from other asset classes amid macroeconomic uncertainty, at least in the short term and around the halving.

Traders also draw insights from previous halving events in Litecoin and Bitcoin Cash, cautioning against assuming a rally in Bitcoin where its counterparts didn’t experience one. Bitcoin’s recent streak of weekly gains, its longest since May 2019, adds an intriguing layer to the debate, hinting at potential market dynamics leading up to and following the halving.

This information is not legal advice. Do your own research before making any decisions. Only invest what you can afford to lose and seek independent financial advice if needed. Understand the risks involved before purchasing any cryptoassets.