In light of the Binance and Coinbase litigation news, exchange Bitcoin holdings remain solid.Bitcoin’s three-month lows did not cause panic selling, according to on-chain data.

BTC investors, according to analytics firm Glassnode, have mostly ignored the current crypto exchange legal challenges.

BTC/USD fell to $25,350 on June 6, its lowest level since mid-March, but it appears that existing holders are unconcerned.

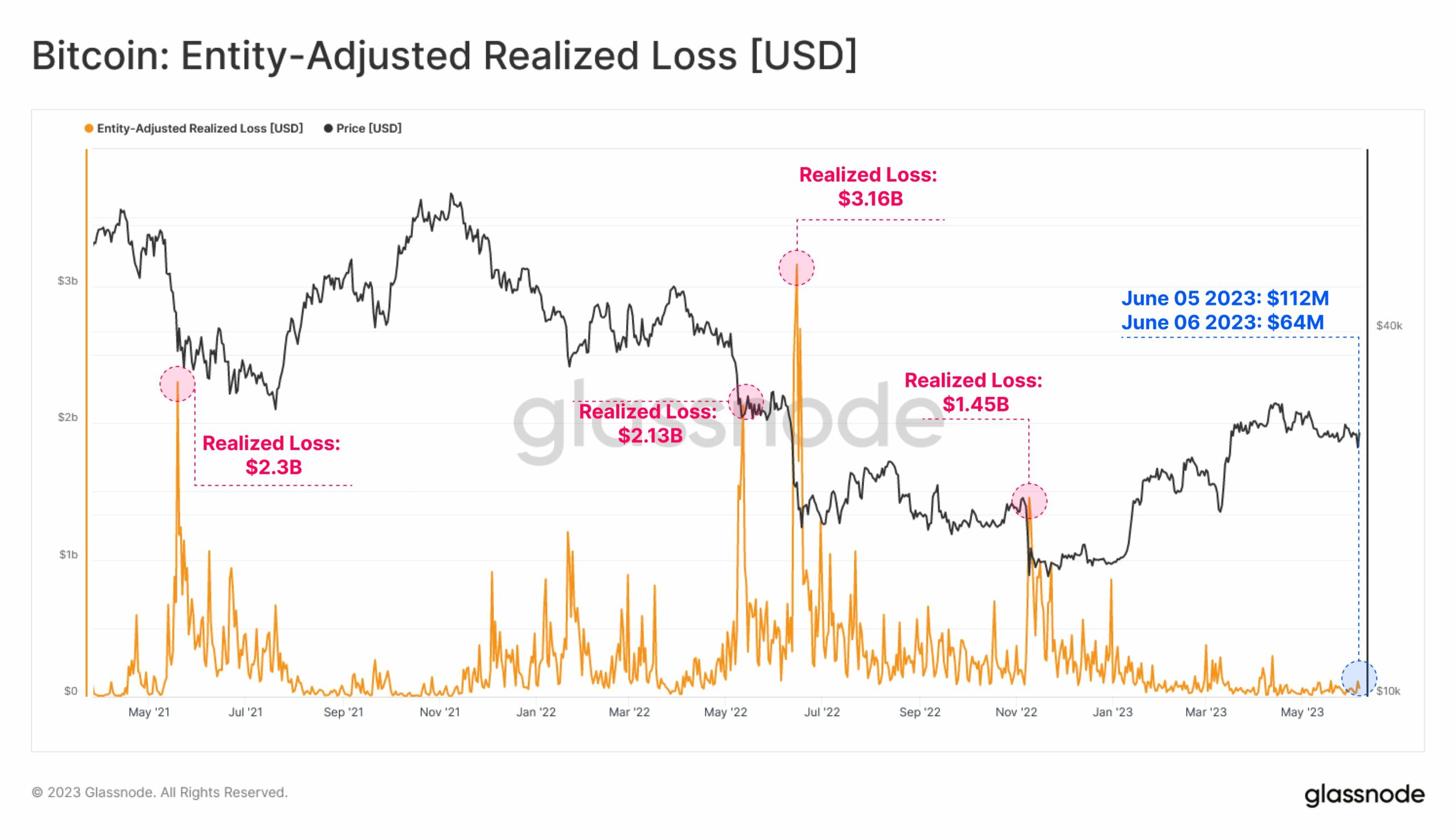

According to the most recent data on on-chain transactions, few people were in “panic sell” mode as a result of the Binance and Coinbase litigation.Glassnode’s Twitter chart showed realized losses — coins moving at a lower value than their prior transaction — remaining calm

This indicated a reversal in investor mood, in stark contrast to the events that followed the crash of exchange FTX in late 2022.

“Following a crescendo in US regulatory pressure on major cryptocurrency exchanges Binance and Coinbase, the market experienced significantly volatile moves in both directions,” according to Coinglass.

“However, the magnitude of Realized Losses recorded On-Chain remains quiet at $112M.

This remains -$3.05B (-96.5%) smaller than the largest recorded capitulation event, suggesting an increased degree of resilience amongst market participants.”