Bitcoin, the world’s first and most popular cryptocurrency, has experienced dramatic price swings since its inception. Its value can fluctuate wildly within short periods, leaving investors and enthusiasts alike on edge. But what drives these price fluctuations?

Factors Influencing Bitcoin’s Price

Several key factors contribute to Bitcoin’s price volatility:

Market Sentiment: Investor confidence and overall market sentiment significantly impact Bitcoin’s price. Positive news, such as increased institutional adoption or favorable regulatory developments, can lead to price surges. Conversely, negative news or market downturns can trigger sell-offs.

Supply and Demand: Like any asset, Bitcoin’s price is influenced by supply and demand. As demand for Bitcoin increases, its price tends to rise. Conversely, if more Bitcoins are sold than bought, the price may decline.

Regulatory Environment: Government regulations and policies surrounding cryptocurrencies can have a profound impact on Bitcoin’s price. Clear and favorable regulations can boost investor confidence, while restrictive measures can dampen enthusiasm.

Technological Advancements: Developments in Bitcoin technology, such as increased transaction speed or scalability improvements, can positively impact its price. However, security breaches or technical issues can lead to price declines.

Macroeconomic Factors: Global economic conditions, including inflation, interest rates, and geopolitical events, can influence Bitcoin’s price. During periods of economic uncertainty, investors may turn to Bitcoin as a hedge against inflation or as a safe-haven asset.

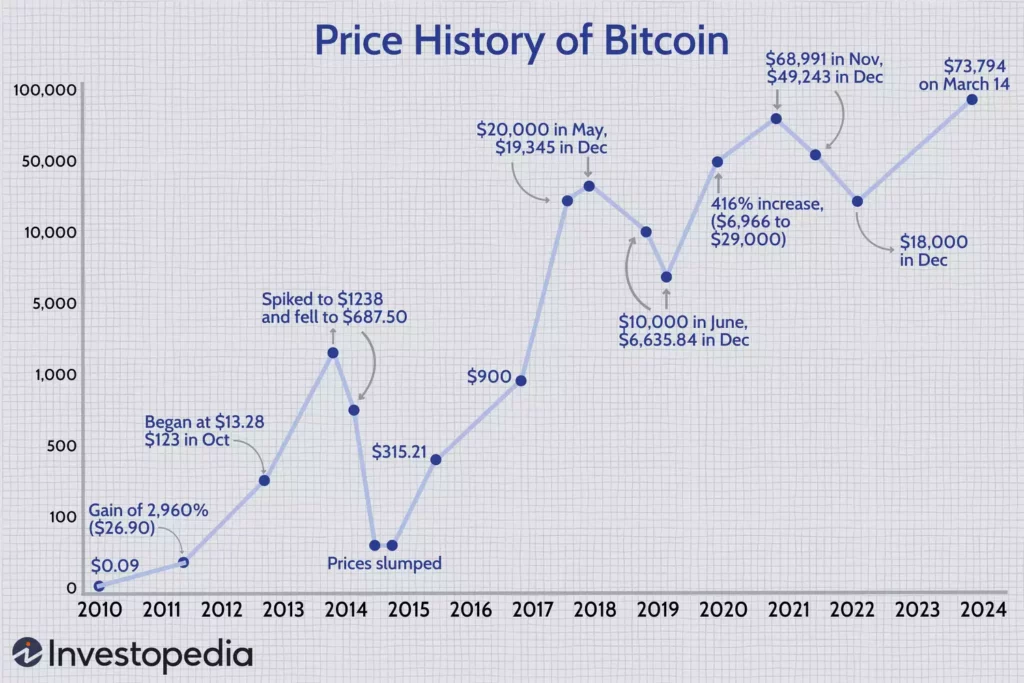

Bitcoin’s Recent Performance

Insert a recent Bitcoin price chart here

Note: To provide the most accurate and up-to-date information, please replace this placeholder with a current Bitcoin price chart.

As you can see from the chart, Bitcoin’s price has exhibited significant volatility in recent times. Factors such as the ongoing global economic recovery, regulatory developments, and investor sentiment have all played a role in shaping its price trajectory.

Conclusion

Bitcoin’s price is a complex interplay of various factors. While its volatility can be daunting, it also presents opportunities for investors who understand the underlying dynamics. It’s essential to conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

This information is not legal advice. Do your own research before making any decisions. Only invest what you can afford to lose and seek independent financial advice if needed. Understand the risks involved before purchasing any cryptoasset